A well-executed PPC campaign can be crucial to an advertiser’s overall conversions and revenue.

What better way to find potential customers than when they search on Google or Bing and tell you exactly what they’re looking for?

However, because you pay for every click you get from your ads, a poorly managed PPC campaign can cost more (sometimes a lot more) than the revenue it brings in.

Target audience and messaging are unique to your business, but there are some basic tactics that work consistently in PPC campaigns, regardless of industry.

There is no silver bullet to a healthy and productive PPC campaign, but there are many levers you can adjust to maximize your outcomes.

Here are eight of the most important (but often overlooked) elements when optimizing PPC campaigns.

Some of these are more advanced than others, but if you implement these elements into your paid search efforts you should see a big improvement and make your business more money!

1. Make Your Landing Page Relevant

This is one of the most overlooked aspects of paid search.

It’s easy to get lost in the paid search platforms, tweaking bids, testing ad copy, and funneling all your energy into the platform itself.

But something important happens after that user clicks on an ad in that platform you’re so focused on: they go to your website!

The ultimate goal of PPC marketing is to make a sale.

A successful PPC ad drives qualified leads to a landing page, but that’s only the first half of winning.

It is then the job of that landing page to convert that prospect into a paying customer.

You should optimize your landing pages for PPC conversions by making the message of your ads align with your landing page message.

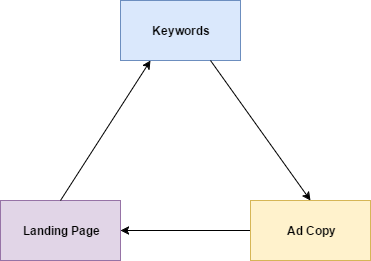

Maintaining consistency between your keywords, ad copy, and landing pages should improve both your click-through and conversion rates while lowering your CPC.

Ideally, the outcome is you make more money while also maximizing your budget.

Repeat the copy points in your ad on your landing page.

Since you know your customers are interested in your offer and message in your ad, you can increase conversions by presenting the same message and CTA on your landing page.

By following this basic rule, you will be able to craft more compelling ads that will help your customers understand your value and drive more conversions.

2. Optimize Negative Keywords

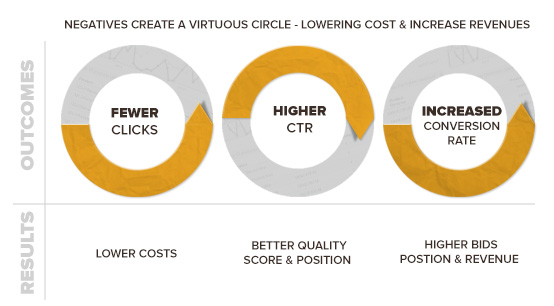

One of the most powerful tools at your disposal to ensure the integrity of your Google Ads and Microsoft Ads campaigns is to utilize negative keywords.

Both platforms let you specify what keywords are not a good fit for your product or service.

By telling Google what your product is not, you prevent your ads from showing on keyword searches that don’t align with the customers you want.

For example, let’s say you are an apartment management company that owns several off-campus student apartment complexes.

These apartments are made for students, not traditional families.

To ensure they only receive qualified traffic, you can exclude terms like “family” along with “cheap” and other qualifiers to negate traffic from searchers that aren’t in your demographic.

It is just as important to tell Google what your product and service is not just as much as it is to tell them what you are.

Negative keywords can be added to the campaign level, but you can also hone in by adding unique keywords to specific ad groups.

3. Use the Right Keyword Match-Types

PPC advertising is a direct attribution marketing channel, and Google Ads relies on user intent through keywords.

Whenever someone types in a search query into Google, ads are shown based on how relevant the auction system considers the search term and displays an ad accordingly.

The keywords you use and the type of modifiers you use for those words in your PPC campaign are important to understand.

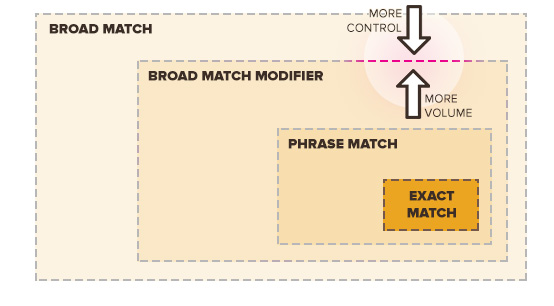

There are four types of keyword matches, meaning four possible ways you can “tell” Google and Bing to handle the keywords you bit on.

- Broad: This is the widest net you can cast and will match searches with any words in any order (including synonyms) that include the target keyword.

- Broad Match Modified: This match type is the second widest net you can cast. Unlike Broad Match, which can allow your ad to show for any keyword in the phrase you’re bidding on, Broad Match Modified tells Google “it must have all of these terms in the search query, in any order or placement.”

- Phrase Match: This modifier will show your ad only when searchers use the exact phrase you specify. The query must contain all the keywords you note, in the exact order you input them.

- Exact Match: This keyword modifier is similar to phrase match; traditionally your ads will only show with the exact search query you input, but Google relaxed this somewhat by showing your ad for things like misspellings, plural versions of a word, or inferring interchangeable keywords to what you have specified.

Each match type is a trade-off between impressions, relevancy, and cost.

If you want the most impressions, then Broad Match accomplishes that, typically for the lowest CPC. But, it can also mean you are matched to a bunch of irrelevant searches and cost you money.

On the other hand, Exact Match will have the lowest amount of impressions, but would higher relevancy and click-through rate. The trade-off is it’s typically more expensive.

4. Alter Keyword Match Type Over Time

When launching a brand new Google or Microsoft Ads campaign, I usually start out with several ad groups that have strong themes of similar keywords.

I often start out using Broad Modified match types because they offer a good level of control to qualify when my ads show, but also enough opportunities for the ads to show so I can gather data.

Over time, the focus tends to become more a blend of Modified Broad, Phrase and Exact Match words as the data starts to show what actually converts.

Winning search queries can be “upgraded” to Exact or Phrase, while my Modified Broad continues to be that wider net helping me find new things to bid on.

5. Fill Out All Available Ad Content

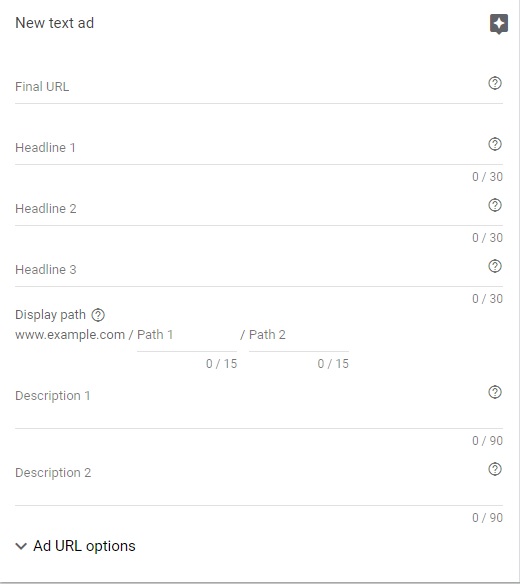

Since their release in July 2016, Expanded Text Ads (ETAs) have made a substantial impact on the world of Google Ads.

By offering additional space for relevant content, ETAs provide PPC managers an excellent way to tell a story about a product or service.

If you want your ads to perform better, make sure you fill out all available information fields.

- Final URL: Make this a highly relevant landing page.

- Headline 1: Include things like the keyword theme the user typed in, your brand name or the primary value proposition in this field.

- Headline 2: Include a supporting value proposition here, or use this area to establish the context for the Description.

- Headline 3: This one doesn’t show as often, but it’s still worth including a strong CTA or value proposition for it.

- Path 1: The Path fields are not the “real” URL, but they are user-friendly insertions to demonstrate relevancy to the searcher. This is a good place to note top-level category, brand name, or keyword category that relates to the ad group (i.e., what the user searched for

- Path 2: Try to include more additional, accurate information in this field to provide further context to the searcher.

- Description Lines 1 & 2: This is the longer section of copy that connects the needs of the searcher with the solution of your product or service. Focus on making this as relevant as possible for what the user searched instead of just dropping in general information about your brand or service. Remember, the searcher is telling you what they need, and this is your area to address it!

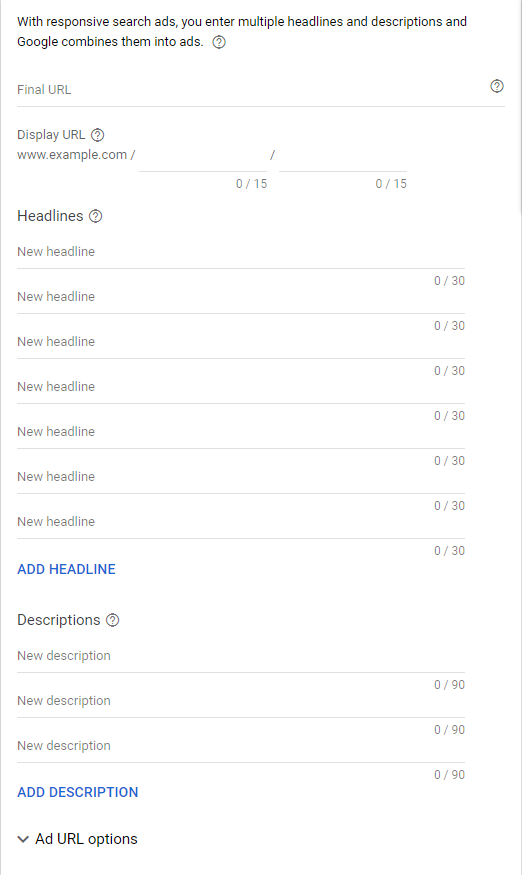

Google has also added the option for Responsive Search Ads (RSAs).

In RSA, you essentially give Google a list of headline options, a list of descriptions options, and Google will test combinations of them together to find the best result.

You can list up to 15 headlines and 4 descriptions:

In any given ad combination, a maximum of 3 headlines and 2 descriptions will show.

It’s important to note they can be put together in any combination, so ensure the headlines and descriptions you put in can be assembled in any way and still make sense!

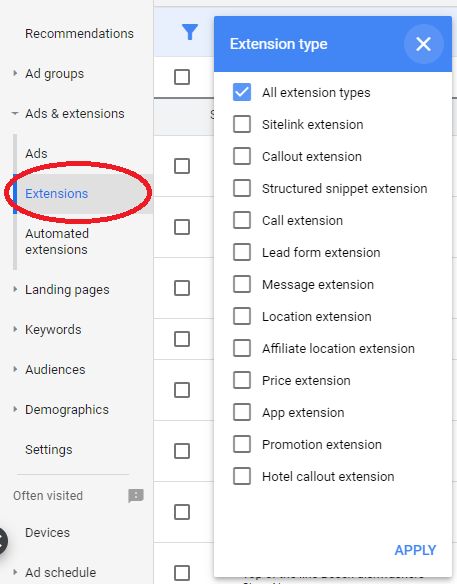

6. Use Every Relevant Ad Extension

A lot of PPC accounts focus mainly on the Headlines, Paths, and Description of the main ad.

However, Ad Extensions are an essential part of the customer experience and can give your ads a considerable performance boost.

Ad extensions can help tell your brand’s story better while offering valuable information to your customers.

There are several ad extensions to choose from, but here are the ones that are most often used:

- Sitelinks Extensions: These are additional links your customers might find valuable that direct to unique landing pages on your website.

- Callout Extensions: Use these to build trust with readers by including entries like “Fast Professional Service” or “Peace of Mind Guarantee.”

- Structured Snippets: Include these to provide more information about features offered. These are based on specific categories, so be sure to choose a relevant category as you build out your ad extensions.

- Call Extensions: This will allow you to pull your business phone number right into the listing.

- Location Extensions: If you are a brick-and-mortar operation, you can link your Google My Business account to your Google Ads account. Enabling this extension will pull in your address and phone number to your ads for potential customers to easily understand your location.

7. Adjust Bids for Geotargeting

No matter your market or industry, you can benefit by focusing your marketing dollars on specific geographic locations.

Review where your engagement comes from to prioritize media spend in those areas.

Local industries like apartments, hotels, and lawyers often qualify their ideal customers by how close they live to their physical offices, but geotargeting performance isn’t limited to this.

Even if your products and services do not depend on your customers’ physical location, you can still optimize your PPC campaigns with geotargeted bids based on seasonality, weather, and user needs.

For example, if you sell snow shovels then you should negative bid in warmer areas like Florida and Alabama since people in those states likely won’t need your product and you will be wasting money on each click from those states.

However, you would increase geotargeted bids for cities that will experience increased snowfall from an incoming cold front.

Many Google Ads beginners forget to consider the needs of their different customer types and other qualifiers based on the physical location of their audience.

You can save a lot of money by preventing ads from showing in some areas while increasing the likelihood of a conversion and increased bid adjustment in other geolocations.

You may also notice that large cities like New York and Los Angeles eat up budget quickly, but are expensive and don’t convert well.

These types of issues can also be addressed with geography-based modifications.

8. Look for Opportunities to Drive Budget to Mobile

Many of your future customers use mobile devices, and more and more, users convert on them.

Mobile-focused campaigns can potentially give you the best chance to engage your mobile customers in the right format on their preferred device.

Separating campaigns is an easy way to drive more qualified clicks.

How do you determine if a campaign should have a mobile-only component?

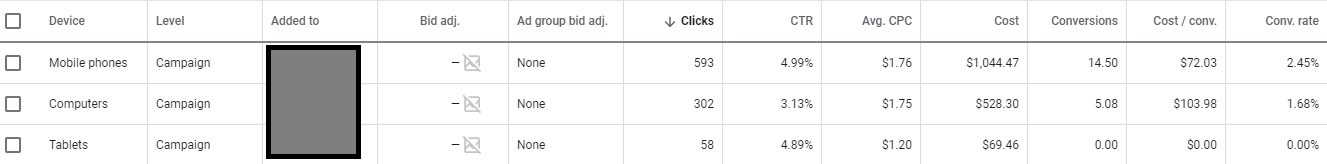

Look at the conversions by device.

As you can see, mobile outperforms desktop and tablet.

In this instance, you can add a positive bid modifier to mobile phone users to maximize your visibility there.

However, if mobile drives a significant portion of conversions and you want to apply budget more aggressively to it, you can also copy an existing campaign and simply negative bid mobile for the original campaign.

In the same way, negative bid desktop in the new mobile-only campaign.

You can also take advantage of mobile-only campaigns by focusing on click-to-call extensions.

Google Ads Is an Investment

A properly maintained PPC campaign can help make businesses drastically increase their revenue.

Because Google charges you for each click on your ads, ensure you take all available steps to optimize the entire experience and drive conversions.

Test out the above suggestions for your PPC campaigns and you should be able to make your business more money with qualified traffic and increased sales.

More Resources:

- 8 Ways You’re Doing Google Ads Wrong & How to Make It Right

- How to Conduct a Complete Google Ads Audit

- Do You Really Want a 100% Google Ads Optimization Score?

Image Credits

All screenshots by taken by author, June 2020