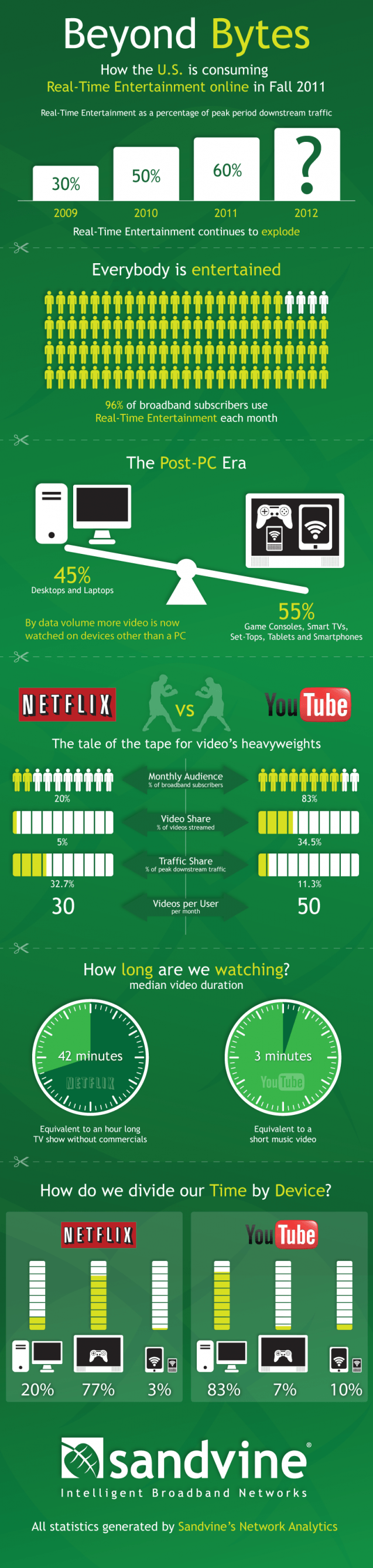

Sandvine announced the release of their 10th Global Internet Phenomena Report: Fall 2011 which includes new Internet trends and extensive analysis of the implications for communications service providers.

I found this report very interesting because I know in my family entertainment has changed massively from watching regular TV to watching Netflix and Hulu. It appears we are not the only one. So if this trend continues, and I assume it will, our industry needs to pay close attention to what advertising options arise for our clients and be the first to take advantage of them.

Major findings in the Sandvine fall report include:

- Within fixed networks in the United States, Real-Time Entertainment applications are the primary drivers of network capacity requirements, accounting for 60% of peak downstream traffic, up from 50% in 2010. Rate-adaptive video represents the majority of video bandwidth, with Netflix alone representing 32.7% of peak downstream traffic, a relative increase of more than 10% since spring.

- We have entered the “Post-PC Era”, as the majority of Real-Time Entertainment traffic (55%, by volume) is destined for game consoles, set-top boxes, smart TVs, and mobile devices being used in the home, with only 45% actually going to desktop and laptop computers over North American fixed networks.

- Video in mobile networks continues to gain momentum. In North America, Real-Time Entertainment is now 32.6% of peak downstream traffic, while in Asia Pacific it is 41.8%. The largest contributor is YouTube, and other applications like peercasting PPStream and Netflix are making inroads.

- Mobile Marketplace traffic accounts for 9.4% of peak downstream usage in APAC and 5.8% in North America, led in both cases by Apple and Google. Applications like Skype and WhatsApp Messenger, that replace the traditional revenue sources of voice and texting, are being installed by growing numbers of subscribers.

- In North America on fixed networks, mean usage remained generally flat at the high end (22.7 GB from 23.0 GB reported in May) and median usage dropped to 5.8 GB from 7.0 GB. This shows that while subscribers aren’t using more traffic overall the usage gap between heavy and light users is broadening and that more data is being used during the small peak period window. In Asia-Pacific fixed networks, median monthly usage is 17.7 GB, which is the largest we have observed.

Here is the infographic they provided: