Quarterly reports from the major ad players have been highly anticipated among the COVID-19 volatility. Google, Facebook an Microsoft all posted their Q1 results this week, reflecting a somewhat universal experience:

Promising growth that was derailed in the last 2-3 weeks of the quarter by the pandemic outbreak.

Google’s Q1 Ad Revenue Results

Google came in strong on Q1, beating analyst estimates. Ad sales were up about 10% versus Q1 of 2019, a dollar amount of $33.8 billion.

YouTube surprised many with strong growth in users and consumption, despite the reduction in ad budget for many industries towards the end of the quarter.

Despite the promising start, Google does not feel optimistic for the rest of the year.

Ad revenues tumbled in the final two weeks of the quarter as COVID-19 became a reality. The expectation is this weakened performance will continue to reflect in Q2 revenues, and possibly longer.

“Performance was strong during the first two months of the quarter, but then in March we experienced a significant slowdown in ad revenues.” – Ruth Porat, CFO of Google

There have been many analysts who lament the economic slowdown will last much longer than COVID-19 will, with a yawning recession to follow. This would continue to impact brands’ bottom lines, and their ability to expend marketing dollars.

Their full report can be viewed on their website.

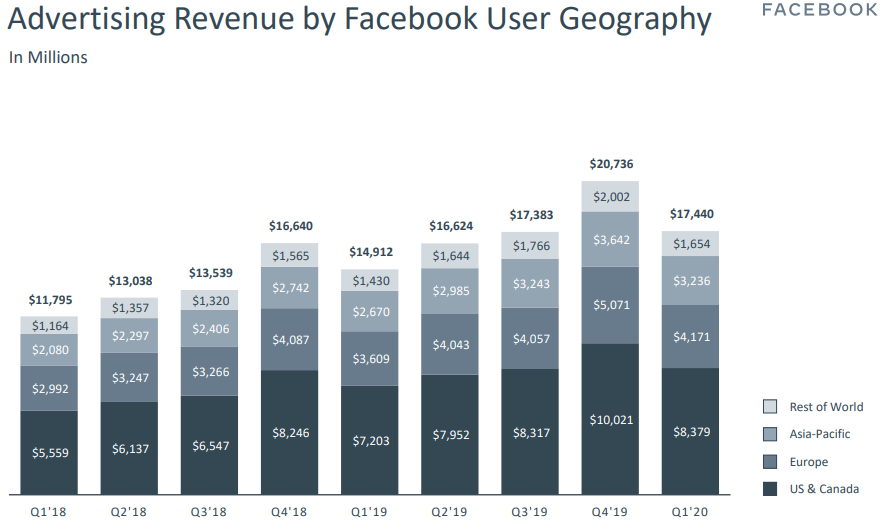

Facebook’s Q1 Ad Revenue Results

Facebook experienced a pattern almost identical to Google, with year over year growth derailed in the final weeks of the first quarter.

Ad revenue grew 17% year over year for first quarter, a number that was better than predicted.

The last three weeks of Q1 reversed this gain, with a drop in ad prices that were noticeable by many advertisers. The drop in price was fueled by a fall in demand, reflective of brands pulling back on spending money as the uncertainty around COVID-19 began.

It wasn’t all bad news for Facebook overall, however. With a large amount of the population following shelter-in-place orders, engagement has skyrocketed as have their active user base.

March reflected an 11% year over year increase of daily active users (referred to generally as DAUs) specifically for Facebook.

The whole family of Facebook’s app properties (which includes Instagram, Messenger, and WhatsApp) increased 12% year over year.

This does little to help their ad revenues, as the messenger services are not monetized. Facebook has added features to encourage more use since Q1, meaning there’s likely continued heavy usage, but no real benefit for it to ad revenue bottom lines.

“The impact on our business has been significant, and I remain very concerned that this health emergency, and therefore the economic fallout, will last longer than people are currently anticipating.” – Mark Zuckerberg

Their full investor report can be found here.

Microsoft Q1 Ad Revenue Results

Microsoft’s report is a little hazier when it comes specifically to their Ads revenue because Microsoft, as a whole, encompasses much larger business units for them.

Their earnings announcement does offer a small summary. Overall search revenue increased 4%, or $75 million. However, when traffic acquisition costs were considered the increase was 1%. They also note a decrease in ad revenue tied to the COVID-19 outbreak.

The Universal Outlook on Q2

All three platforms caution about earnings in the months to come.

With the economy on shaky ground, and brands concerned about their future, the money that is out there is tending to be used more conservatively.

In all three cases, these companies operate in sectors other than advertising. That works in favor for some like Microsoft, whose investment into cloud-based offerings is soaring. That demand is seen also in entities such as Facebook and Google, but the consumer-heavy lean towards free tools makes can mean higher utilization with lower profits for them.

Image credit: Facebook

FAQ

What was Google’s Q1 2020 ad revenue?

Google’s ad sales for Q1 of 2020 amounted to $33.8 billion – up about 10% versus Q1 of 2019.

What was Facebook's Q1 2020 ad revenue?

Facebook’s ad earnings grew 17% year over year for the first quarter of 2020 with $17.4 billion in revenue.

What was Microsoft's Q1 2020 ad revenue?

Overall search advertising revenue increased by 4% or $75 million (total advertising revenue of $1.87 billion). However, when traffic acquisition costs were considered the increase was 1%.