New tax advantages in Luxembourg for companies able and willing to register themselves there, have provided a strong undercurrent in economic news lately. Where income from intellectual property is derived, some companies will save/earn significantly due to these new laws. Let’s take a look at how developing intellectual property assets in Luxembourg could be a windfall.

We became aware of this news via Vayton Brand Capital, a Luxembourg intellectual property management firm that specializes in brand solutions. Their latest announcement of a total management solution for these intellectual properties is innovative in every sense of the term. What this company has come up with, affords businesses an almost unbelievable advantage, for not only tax leniency – but super efficient management of brands, trademarks, domains, and patents – all under one roof.

A case study on the Vayton website describes these benefits of Luxembourg tax laws far more concisely than we can. In their example, a retail apparel client launches its brand across 16 countries worldwide. By collaborating with Vayton, and setting up a consolidated and managed IP solution in Luxembourg, the managed company IP assets are eligible for a huge tax break.

In fact, this can be as much as 80% in many cases. In this simple scenario, Vayton plugs in some numbers, which further forecast the potential windfall. The benefit of the new tax law article 50bis LIR, boils down in this case to the normal tax rate of 28.59% compared to IP derived assets developed and/or managed in Luxembourg – only 5.72 %. The math says it all here.

On IP revenues of say €1,000,000, the company recaptures €187,551. As you can readily see, 18.76 % is a banner year for most companies. Clearly Luxembourg’s recent tax laws are designed with business growth in mind. In the International Tax Review, Samantha Nonnenkamp further outlines article 50bis LIR. Perhaps most importantly for business people reading this:

“The exemption regime will apply to registered patents only and to the extent the IP has been acquired (or created as the case may be) after December 31 2007.”

Along with other provisions, and huge tax breaks in Luxembourg’s system, it is small wonder that the country has not become Europe’s Internet hub. The IP Legislation and more information for Luxembourg is here in PDF format. But, back to the case at hand – Vayton Brand Capital’s fascinating strategy.

Vayton Brand Capital has actually generated a near perfect business solution on closer scrutiny. These laws are complex, but simply offering tax shelter help is not exactly innovation is it? Vayton’s solution is only in the managerial tax and business expertise, but maybe even more importantly, in the actual IP hosting elements.

Overall, the intellectual property development, management, IT & IP tools, and overall accessibility, these make for a powerful suite of offerings, including surveillance, not just consulting. This is where I became interested actually.

Overall, the intellectual property development, management, IT & IP tools, and overall accessibility, these make for a powerful suite of offerings, including surveillance, not just consulting. This is where I became interested actually.

It seems, in as far as we can tell, that Vayton is the only International platform that allows for the management of domains, Trademarks, and Patents from one dashboard – one suite of service features. You have to imagine companies with a portfolio of IP entities – the need for expedience too, in the handling of them.

Talk about a dream niche. Being the only player, offering huge tax incentives, centralized geographically and features-wise, now that is differentiation. For Luxembourg the strategy is clearly designed to reward innovation and dynamic investment. With the banking and other pertinent infrastructures in place there in Luxembourg, movement toward such centralizing methods only makes sense.

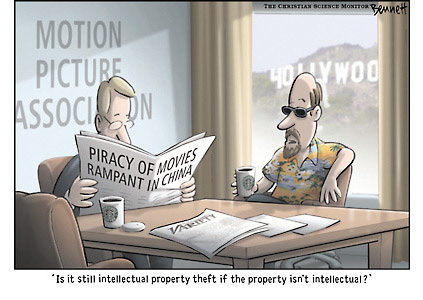

Intellectual property theft cartoon, courtesy Clay Bennet.