Buying a website rather than building one can be a great shortcut to an established online presence. Not only do you save time and tech headaches, you are also buying an inventory, customer goodwill, and online marketing. Sometimes that is something you can’t put a price on.

But buying a website is not without significant risks.

I’ve been fortunate to have handled over 600 website sales over the past 8 years. In that time, I’ve seen a lot of successful buyers make the act of buying a website look simple.

But for every expert buyer who nimbly works the process and acquires a website, there are a handful of buyers who are obviously learning the process for the first time. They tend to make the same mistakes, and some of them subsequently find themselves in really bad financial situations because of it.

I asked my team to identify common mistakes they see buyers making when buying a website. Here’s what they came up with.

1. Failing to Build Rapport with the Seller

Even though buying a website involves negotiating the best deal with the seller, your best partner through the whole process is the seller. The seller represents a treasure-trove of information that is crucial to the future success of the business. Furthermore, no matter how much due diligence you do, you’ll still find that you need the seller to help with the transition, and also train you to run their website.

Some buyers have the attitude that the seller should be grateful that someone wants to buy their website. What you need to understand is that buying a website requires full co-operation from the seller, and the best way to get that co-operation is to build a solid rapport with them.

Failing to Sell the Broker

If the seller is using a broker to help them sell their website, understand that your relationship with the broker is just as important as your rapport with the seller. Possibly even more so.

Sellers pay a lot of money for a broker to help them handle the complex process of selling a website. When a seller hires a broker, they become one of the most important – if not the most important – advisors through the whole process.

So when you are ready to submit an offer, the seller will most likely check with the broker to get their feedback as well. If the broker does not trust you, they will pass on that lack of trust to the seller and you’ll lose out on the deal.

2. Not Setting Clear Expectations About Training Needs

In order to be successful with your new acquisition, you will want to get as much information and assistance as possible, with regards to the transition. The person selling their website is a goldmine of information, facts, and nuances that simply can’t be learned through looking at financial statements and analytical data.

That said, when a business owner sells their website, they are usually ready mentally to move on to their next project. So if they find themselves surprised by a long, drawn out, painful training period, you may find that the transition becomes a bit tense.

Sellers don’t like surprises. So when you make your offer, be upfront about the training you’ll need and expect from them. To sweeten the deal, offer to fly to the seller’s location for 3 days of training to soak up as much information as possible.

3. Spending Too Much Time on the Past and Not Thinking About the Future

When buyers speak of doing due diligence on an acquisition, we usually split this up into two parts – discovery due diligence and verification due diligence. Discovery due diligence is learning how the business works, how it’s performed in the past, and where the opportunities and risks lie in the future of the business. Verification due diligence tries to verify all that was learned in the discovery due diligence.

The problem some buyers run into is they spend too much time focusing on the past and not enough time worrying about the future. To make themselves comfortable with an acquisition, a buyer may work tirelessly to verify every penny on the financial statements for the last three years, while ignoring the trends that will impact the future.

You need to find a balance. It is obviously essential to verify past records are correct, but you need to bear in mind that past records are just one source of data you can use to make a judgement about the future. You don’t get to own what the business did in the past.

4. Buying Outside of Your Budget

Buying a website is good, but if you use money you can barely afford to lose, then that is a recipe for disaster.

I remember working with a buyer who was evaluating a listing of mine that had an asking price of $1.25 million. He wanted to buy the business very badly, so we began to negotiate. He had $800,000 set aside for the acquisition, but that wasn’t enough to get the deal done. He needed to come up with $1.1 million to even remotely spark the interest of the seller.

A few days later he called to inform me that he could move some money out of his retirement account and access a few other sources of emergency funds to come up to the required $1.1 million.

I advised him not to buy the website.

Buying an Internet business is risky. Even the most stable online businesses lack the critical funds that most acquisitions fall back upon to regain some value in the event of a catastrophic downfall. One good example is the first Google Panda updates in 2013. There were a lot of smart buyers who bought some top rated websites that Panda suddenly turned into vacant piles of code.

Buying an online business comes with incredible advantages, but those advantages come with risks attached. Always understand the risks, and don’t spend what you don’t have.

5. Buying Outside of Your Expertise

I personally experienced this mistake several years ago. As embarrassing as this is to admit for a man in my position, a few years ago I acquired a group of e-commerce websites. These were old websites with historically great rankings and an outdated backend system (there was actually no backend system, that’s how outdated it was). They were a perfect candidate for a flip. The only problem was that I had never done e-commerce before.

One year later, after getting a crash course in running an e-commerce website, I sold the websites for a loss. I learned a lot, and I didn’t lose a lot (other than time), but I definitely was a bit too ambitious.

Unfortunately, I see buyers make this mistake repeatedly. After a few successes online, they jump into a new area of the Internet and think they can replicate the same success. A few months later, they are struggling to learn what feels like a completely different industry.

The difference between a lead generation business is light years away from an e-commerce operation with an in-house fulfillment center. The difference between a Software as a Service (SaaS) subscription business is significant compared to an online, multi-authored blog and magazine.

6. Too Much Focus on the Multiple

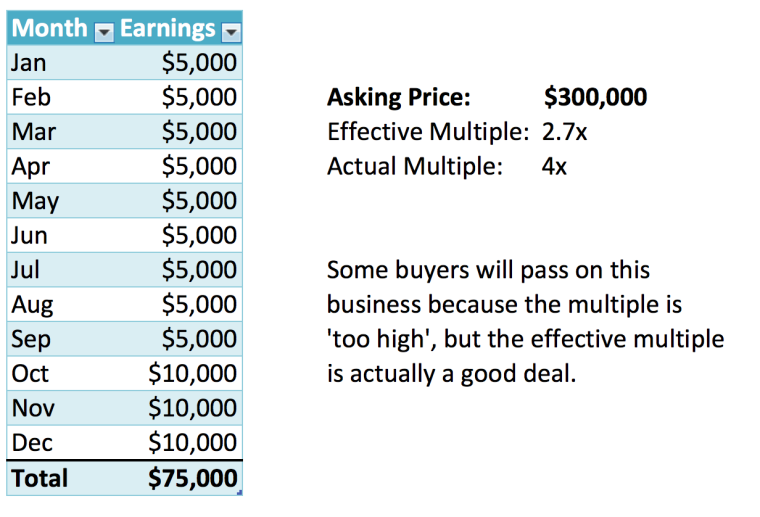

Most online businesses are valued at a multiple of their earnings. For example, if a website generates $100,000 a year in bottom line earnings, a buyer may pay a 3x multiple on that, making the sale price $300,000.

The problem some buyers run into is that they hold onto their target multiple far too strictly. This causes them to lose out on some good deals, or potentially overpay on a bad deal.

The earnings multiplier approach to determining price is overall pretty effective, but it has its significant drawbacks as well. For example, an earnings multiplier approach fails to take into account recent changes in the business.

Here’s an example. Let’s assume you run an online business that was generating $5,000/month in earnings. However, three months ago you signed a new supplier contract that had an immediate impact of doubling the earnings to $10,000/month.

For the seller, it is very reasonable to assume that their future annual earnings will be $120,000 a year as opposed to $60,000 a year.

Based on this new trajectory, the seller may ask a buyer to pay $300,000 for their business (an effective multiple of 2.5x). However, many buyers will only look at the past earnings of $75,000 and see an actual multiple of 4x.

Hopefully you can see how a buyer would completely miss a good opportunity if they set a strict rule of not paying more than 3X for any online business.

When you look for a website to buy, always understand the ratio of the asking price to past earnings in context. How is the business poised to work in the future? What is its trajectory? Most importantly, what level of return will it provide for you?

The problem some buyers run into is that they get stuck by looking only at the past earnings of the business and fail to understand how it will look under their own ownership.

7. Failure to Plan an Effective Transition

I am a very laid back guy. When I go on vacation, I hate to plan my days. My preference is to just enjoy the ride and experiences as they come.

While this is a great way for me to experience my vacations, this is a terrible approach to planning the transition of a business. But this is, unfortunately, how many buyers approach the transition between the seller and themselves. They simply assume that ‘everything will be fine’ and fail to plan carefully.

Planning a transition isn’t terribly difficult to do, so there is little excuse for not making something of a plan. To help plan your transition, consider the following:

- List every account that the seller has that you’ll need to get set up

- Identify the requirements for getting them set up

- Identify all the assets of the seller that need to be transitioned (domain names, historical records, inventory, if applicable, etc)

- When will you and the seller ‘flip the switch’ and start the revenues to begin flowing to your account?

- What do you need to make sure that happens?

- When will your first training session be with the seller?

8. Failing to Recognize You are Responsible for Your Investment

Deciding to buy a website is a decision that will ultimately benefit you. The flip side of this benefit is you are ultimately responsible for how you make that investment.

Many buyers make the mistake of handing over the most important decisions to advisors. For example, many buyers will hand over the final contract to an attorney who returns the contract full of one-sided, heavy-handed language that no seller would reasonably agree to.

Ultimately, these attorneys are trying to do their jobs, but they do them in a different context than you. Understand that buying a business is ultimately your responsibility and no one else’s. Advisors exist to give you advice. Sellers should answer your questions honestly and without hesitation. But the decision to write that check ultimately falls on your shoulders.

Conclusion

Much of this post focused on the negative things buyers do and the fallout that can occur if you make the same mistakes. But don’t let that scare you away from the world of buying websites. As I said in the introduction, I’ve seen many buyers who nimbly walk through the process of buying online businesses and see phenomenal returns.

But be careful. Know your limitations, both financially and with your skillset. Understand that data tells a story so you can make a judgement about the future. Treat all people in the transaction with respect.

Follow these rules and you’ll avoid some of these most common mistakes.

Image Credits

Featured Image: FXQuadro/Shutterstock.com

In-post Photo: Image by Mark Daoust