Rapidly changing, highly competitive, filled by tremendous amounts of newcomers emerging as we speak – this is how the US Online Travel & Tourism Industry can be generally described. Despite all the challenges, there are some players who successfully manage to reach and remain in top positions in the biggest search engine results. Following, we will explore who they are and which are the most competitive categories in which their domains “fight” to dominate.

The Top 5 Domains in the Travel & Tourism Industry

The following infographic illustrates the aggregated visibility of the current top 5 competitors in the US Travel & Tourism Industry over the past 6 weeks, including both Organic and Paid visibility:

Image credit: Hoosh.com

Image credit: Hoosh.comThe top players receive the following percentages of aggregated visibility, respectively: Expedia.com – 39.2%; Kayak.com – 18.9%; TravelandLeisure.com – 16.1%; Orbitz.com – 15.5%; and Priceline.com – 10.3%. Data was extracted on 3/12/2013.

Expedia and Kayak lead the charts

It doesn’t take much to observe that Expedia.com and Kayak.com are direct competitors in the “fight” for visibility, as a logical result of the similar nature of their business. Expedia and Kayak are both among the world’s largest online travel agencies with a solid presence across the globe via local websites. The travel companies work as aggregators of a large range of flight & hotel deals, car rentals, vacation destinations and cruises. Additionally, Expedia and Kayak provide their customers with ideas, deals and information through a mobile app and have a solid presence in social media.

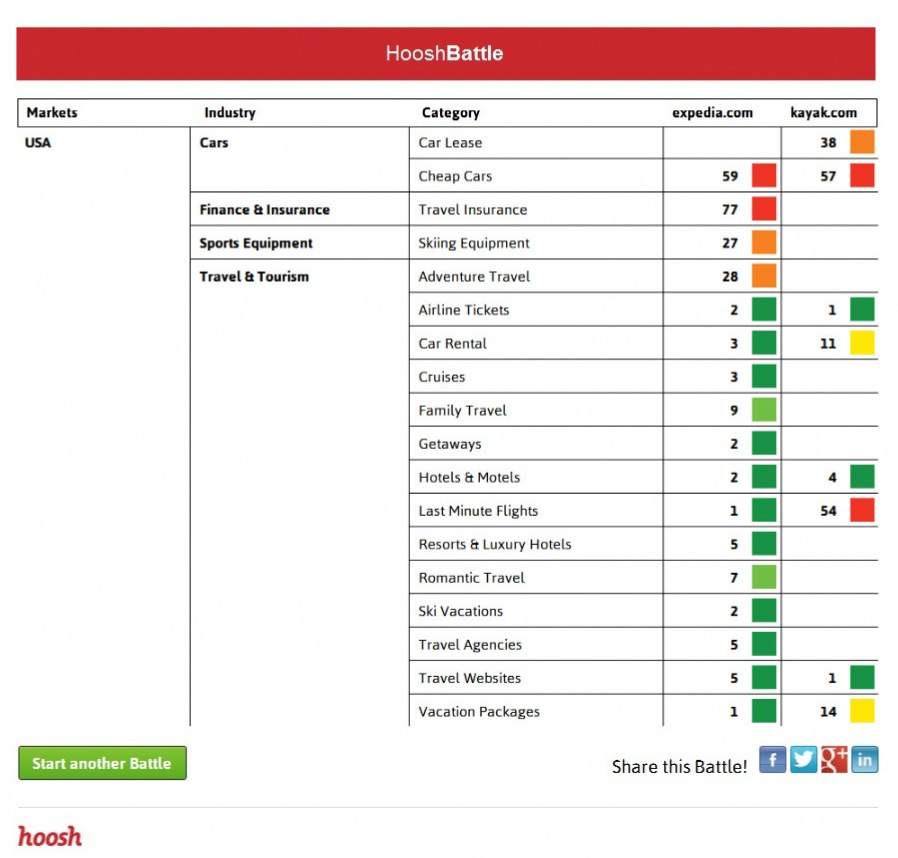

This calls for a battle! Let’s see what happens if we place the two domains in a direct “fight”, and get a more detailed overview of the Categories in which they are direct rivals. Here is an extraction of the results, specifically of the US Market:

Screenshot taken 2/12/2013 of http://battle.hoosh.com

Screenshot taken 2/12/2013 of http://battle.hoosh.comThe screenshot represents the battle between Expedia and Kayak, only partially. The first table contains the ranking of Expedia.com, and the second of Kayak.com. The battle was conducted on 2/12/2013.

Two conclusions come to mind after a first glimpse:

- Expedia is a Market Leader in a greater number of Categories (11 Total) within the Travel & Tourism Industry, however both domains rank #1 in an equal amount of Categories.

- “Airline Tickets” is the Category in which Expedia and Kayak are direct competitors for Visibility.

Further Insights: Paid vs. Organic Search Strategy

Because, as mentioned before, Airline Tickets was the category in which the two domains are direct competitors, we decided to compare how their visibility is spread among Organic and Paid. Here comes the interesting part:

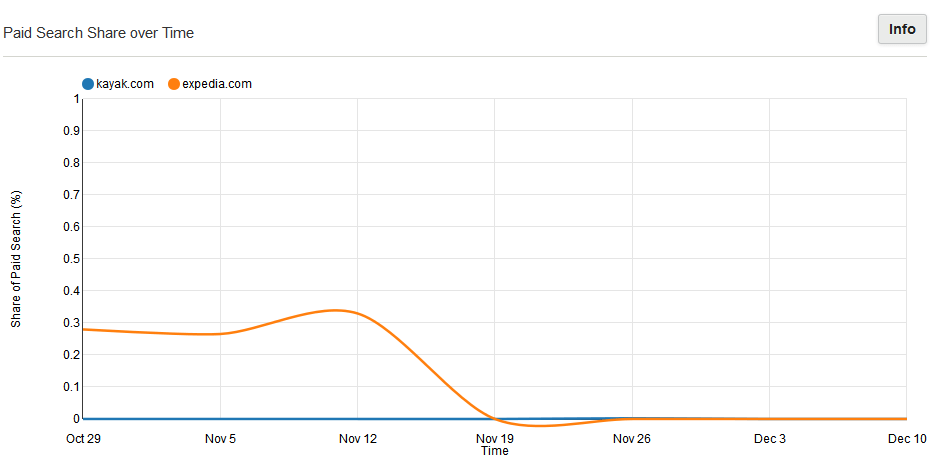

You probably think that the top players in an extremely competitive Category, such as Airline Tickets, often have to spend significant resources on AdWords, PPC, etc. in order to “buy” their way to the top. On the contrary, both Expedia and Kayak have spent little (Expedia.com) to zero (Kayak.com) in paid visibility on the top generic keywords that we track for the Industry for the last 6 weeks:

Screenshot taken 12/12/2013 of http://ii.hoosh.com

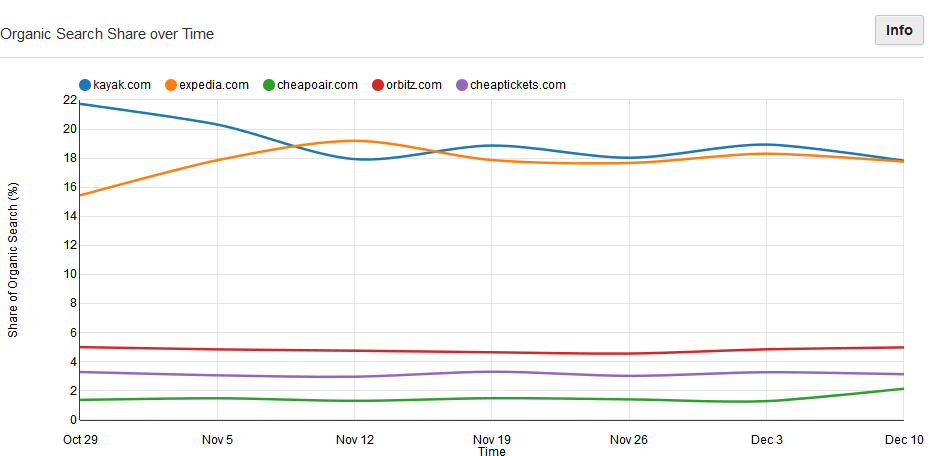

Screenshot taken 12/12/2013 of http://ii.hoosh.comThe real rivalry between Expedia and Kayak in the Airline Tickets Category can be easily observed in their organic results:

Screenshot taken 12/12/2013 of http://ii.hoosh.com

Screenshot taken 12/12/2013 of http://ii.hoosh.comTo summarize, the analysis of two top players in the US Online Travel & Tourism Industry points out a key takeaway for marketers struggling to achieve better visibility with their Search Marketing efforts: spending resources on Ads to gain positions in paid visibility does not necessarily guarantee leading positions in the biggest search engine results. Players like Expedia and Kayak, with their impressively strong organic positions, are proof of that.